Financial Recovery Strategies in Connecticut's Personal Injury Cases: Guidelines for Long-Term Financial Stability

## Managing a Personal Injury Settlement in Connecticut: A Comprehensive Guide

Navigating a personal injury case in Connecticut can be a complex process, particularly when it comes to managing the settlement. This guide outlines key steps to help individuals ensure their settlement funds support both their immediate needs and long-term financial recovery.

### 1. Building a Strong Legal Foundation

Partnering with an experienced personal injury lawyer is crucial. They will help gather and preserve evidence, calculate potential damages, and handle negotiations with insurance companies. Remember, Connecticut follows a comparative negligence rule, so it's important to present your case in a way that maximizes your compensation[1][3]. Preparing for trial, even if a settlement is expected, often leads to better offers[1].

### 2. Comprehensive Damage Calculation

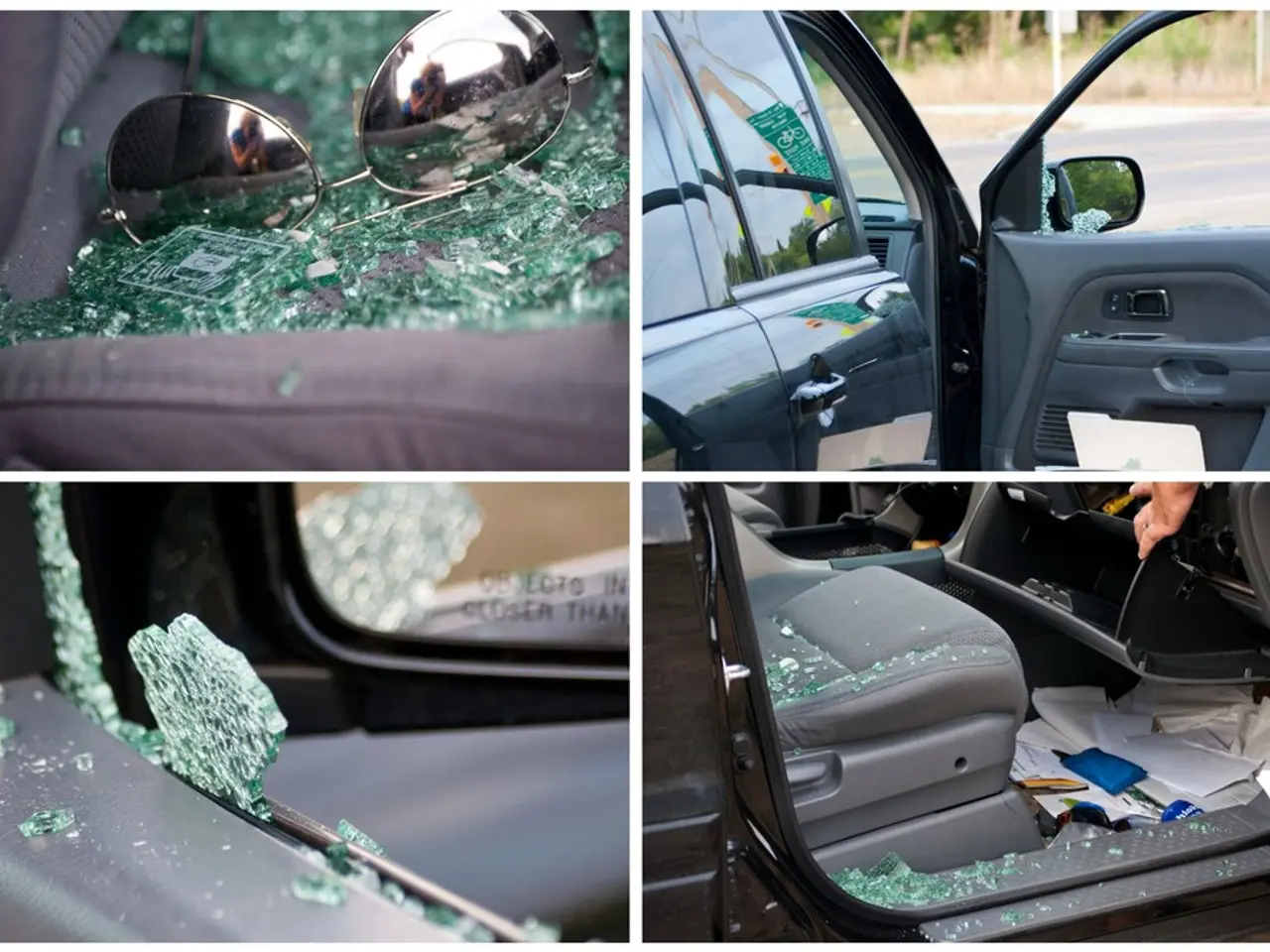

Ensure your settlement includes both economic damages (medical bills, lost wages, property damage) and non-economic damages (pain and suffering, disfigurement, loss of consortium)[3]. Work with financial planners and medical experts to estimate long-term costs, including lost future earnings, ongoing medical care, and lifestyle adjustments. This helps secure compensation that truly supports your recovery[1][5].

### 3. Financial Resilience and Planning

Protect your settlement against inflation and rising costs, such as those due to extreme weather or insurance increases[2]. Review your insurance coverage to ensure adequate protection against future risks, and consider bundling policies for discounts[2]. Resist the temptation to spend settlement funds quickly. Prioritize paying off debts, covering ongoing medical expenses, and building a financial buffer.

### 4. Utilizing Available Opportunities

Consider a structured settlement, which provides periodic payments over time instead of a lump sum. This can help manage spending, provide ongoing financial support, and may offer tax advantages[5]. Work with settlement planning experts who can help project costs, manage investments, and provide creative solutions tailored to your unique situation[5]. Engage professionals who offer mediation and negotiation support to ensure your settlement is structured in a way that best serves your long-term interests[5].

### 5. Long-Term Financial Recovery Strategies

Invest settlement funds wisely, preferably in low-risk vehicles that provide steady returns and protect principal, especially if your settlement is your main source of future income. If your injury affects your ability to work, use settlement funds for retraining or education to improve your long-term employability. Schedule periodic reviews with your financial team to adjust your plan as your needs and external conditions change.

## Summary Table: Managing a Personal Injury Settlement

| Step | Description | Key Benefit | |---------------------------|--------------------------------------------------------------------------------------------------|-------------------------------------| | Legal Representation | Hire a personal injury lawyer to maximize settlement and handle negotiations[1][3]. | Higher, fairer compensation | | Damage Calculation | Account for all current and future costs, including non-economic damages[3][5]. | Avoids future financial shortfall | | Insurance Review | Ensure adequate coverage to protect against future risks[2]. | Prevents new financial setbacks | | Structured Settlements | Consider periodic payments for long-term support and tax benefits[5]. | Sustainable income stream | | Expert Planning | Use settlement planning and financial experts for tailored strategies[5]. | Maximizes utility of settlement | | Investment & Education | Invest wisely and retrain if needed for future employability. | Long-term financial resilience |

## Conclusion

Effectively managing a personal injury settlement in Connecticut involves careful legal guidance, thorough financial planning, and taking advantage of structured settlements and expert advice. This approach helps ensure your settlement funds support both your immediate needs and your long-term financial recovery[1][3][5]. Working with human resources professionals can provide guidance on navigating the system and using it to your advantage. The primary goal of recovering damages from a personal injury case is not only physical recovery but also financial recovery. Managing your settlement from a personal injury case in Connecticut is crucial to bouncing back financially. The goal of financial recovery management is not just to achieve stability, but to move towards prosperity.

[1] Berkowitz Hanna Malpractice & Injury Lawyers. (2021). Personal Injury Law in Connecticut. Retrieved from https://www.berkowitzhanna.com/practice-areas/personal-injury/

[2] Insurance Information Institute. (2021). Connecticut Auto Insurance. Retrieved from https://www.iii.org/state-resource/connecticut

[3] Nolo. (2021). Connecticut Personal Injury Laws & Statutory Rules. Retrieved from https://www.nolo.com/legal-encyclopedia/connecticut-personal-injury-laws.html

[4] Connecticut Department of Labor. (2021). Workers' Compensation. Retrieved from https://www.ctdol.state.ct.us/workcomp/

[5] Settlement Planning Solutions. (2021). Connecticut Settlement Planning. Retrieved from https://settlementplanningsolutions.com/connecticut-settlement-planning/

Awareness and utilization of science and technology can aid in both calculating damages and managing finances during the personal injury settlement process. Financial planners and medical experts, for instance, can use advanced technology to estimate long-term costs, such as lost future earnings, ongoing medical care, and lifestyle adjustments. Moreover, engaging professionals who offer mediation and negotiation support, as well as settlement planning experts, can help ensure your settlement is structured in a way that best serves your long-term interests. In terms of health-and-wellness, it's imperative to prioritize spending settlement funds on paying off debts, covering ongoing medical expenses, and building a financial buffer, to ensure a smooth recovery both physically and financially.